EXECUTIVE SUMMARY

The Thai beverage industry heavily depends on the domestic market, accounting for over 79% of total sales. In 2022, the overall production and sales recovered after the COVID-19 pandemic, and economic activities were normal. However, during the first 8 months of 2023, the overall production and sales situation declined due to the purchasing power of consumers, which was affected by high living costs, as well as the increase in product prices due to rising costs and the sugar control tax increase.

In 2024-2026, production is expected to grow slightly by an average of 1.5-2.5% per year. Domestic sales are expected to grow by 3.0-4.0% per year, driven by:

- The full recovery of business activities, especially the restaurant, hotel, pub, and bar industries;

- The humid weather conditions caused by the El Niño phenomenon and

- The continued expansion of cities and convenience stores.

Exports are expected to grow by 1.5-2.5% per year as neighbouring countries gradually reopen border trade checkpoints and purchasing power recovers. However, expanding production from Thai businesses’ overseas investments may limit export growth.

The outlook for overall beverage producers in Thailand in 2024-2026 is expected to recover gradually, in line with the economic recovery, the restaurant industry, and domestic tourism. However, they may face higher water and agricultural raw material costs due to the intensifying El Niño phenomenon.

Water and bottled mineral water producers: Revenue is expected to increase, driven by the recovery of the domestic economy and tourism, which will support water demand, especially from the restaurant, hotel, and entertainment industries. In addition, demand for clean, uncontaminated water from CLMV countries, which are major trading partners, is expected to recover after border trade returns to normal.

Soft drink producers: The increasing business activities amid rising temperatures make consumers more inclined to consume refreshing beverages. Despite the impact of the sugar tax, many producers have adapted by using sweeteners instead of sugar. In addition, developing new products for health-conscious consumers, such as vitamin-infused soft drinks, alcohol-flavored soft drinks, and fruit-flavored sodas, will help boost revenue.

Beer producers: Revenue is expected to recover gradually, driven by the restaurant, pub, bar, and nightlife venues that have resumed operations as normal to support increasing social gatherings. In addition, the release of various products with new and innovative flavours will continue to stimulate consumer interest. However, higher agricultural raw material costs due to drought may pressure profitability.

Liquor producers: Consumption is expected to decline as prices rise in line with raw material costs. In a situation where consumers are still cautious about spending, coupled with consumer behaviour shifting to focus more on healthy beverages, producers are likely to accelerate product development by increasing the quality of alcohol ingredients to enhance satisfaction and a better consumption experience.

The Thai beverage industry is expected to recover gradually in the next three years. However, the industry will face some challenges, such as rising water and agricultural raw material costs.

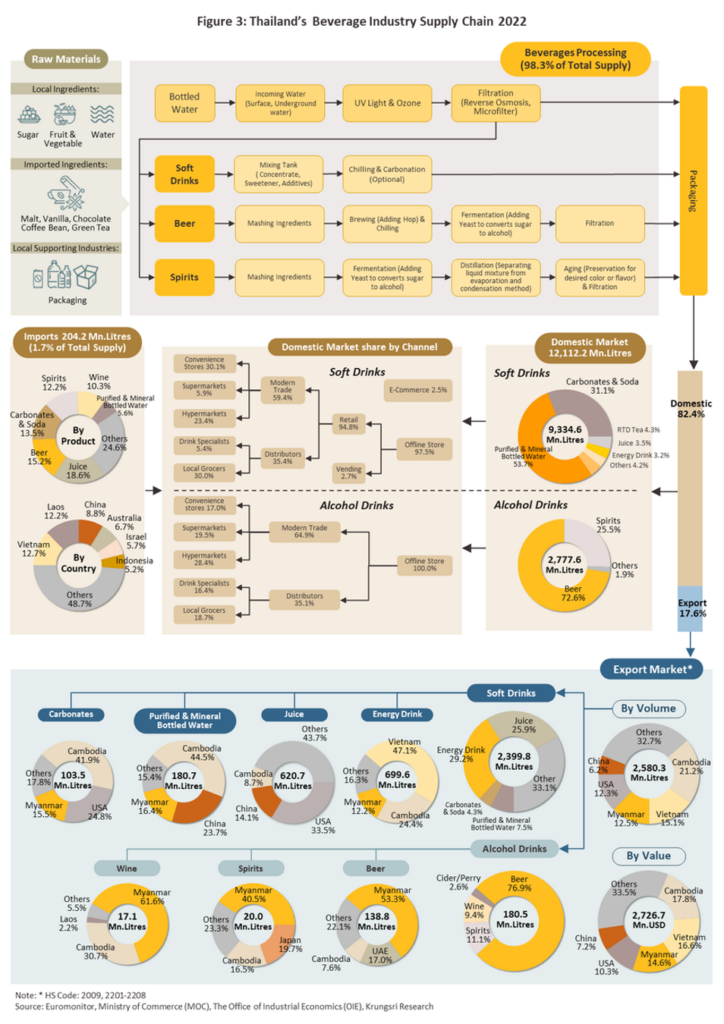

Basic Information

The Thai beverage industry has a production share of 98.3% of the total domestic consumption of beverages. It focuses on domestic sales, accounting for 78.7% of total production in Thailand. The rest is for export. The import volume accounts for only 1.7% of domestic beverage sales. The import volume of non-alcoholic and alcoholic beverages is 43:57 and 20:80 in value.

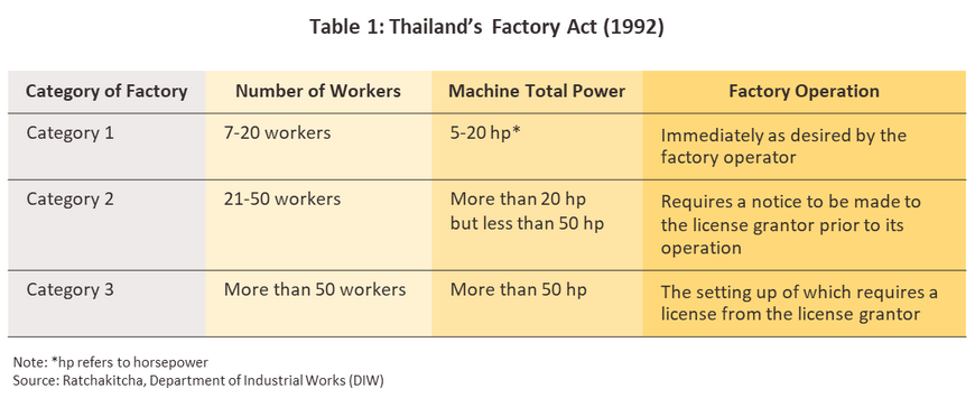

In 2022, the Thai beverage industry had 393 factories registered with the Department of Industrial Works. Most of them are located in the Central region. Nakhon Pathom province has the most beverage factories, with 38 factories. The following are the provinces with the most beverage factories: Pathum Thani (30), Chonburi (29), Ayutthaya (24), Samut Sakhon (18), and Bangkok (18). The total number of beverage factories is divided into:

- 332 non-alcoholic beverage factories, accounting for 84% of the total beverage production plants.

- 61 alcoholic beverage factories, accounting for 16% of the total beverage production plants.

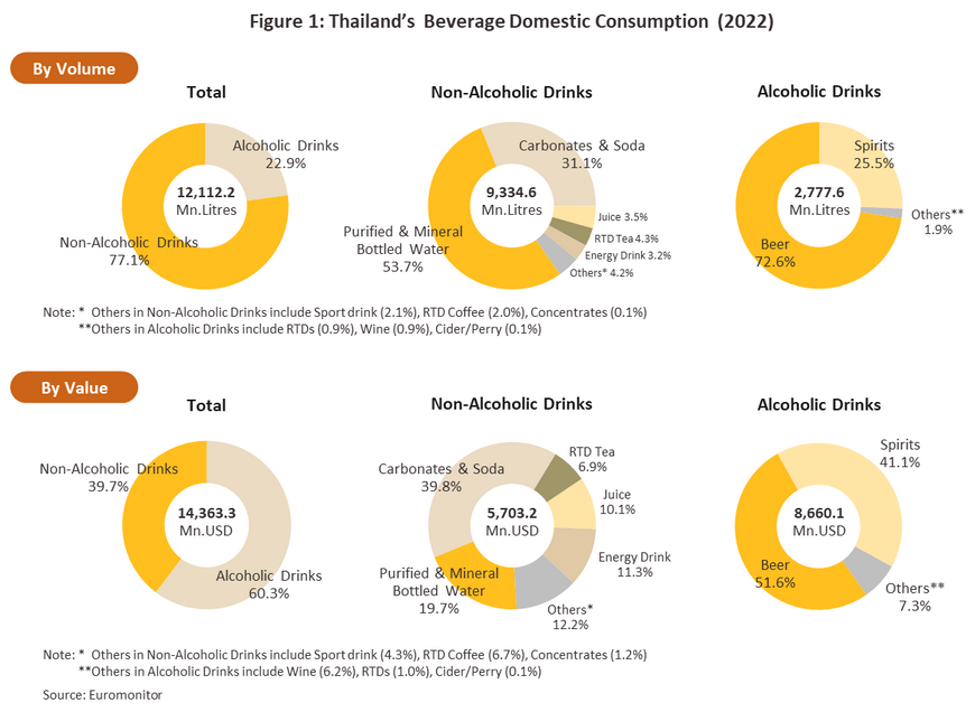

In 2022, Thailand’s domestic beverage sales volume was 12,112.2 million litres, worth 14,363.3 million USD. It was divided into non-alcoholic beverages and alcoholic beverages, accounting for 77:23 in terms of volume and 40:60 in terms of value (Figure 1). The details are as follows:

Non-alcoholic beverages

The domestic sales volume of non-alcoholic beverages was 9,334.6 million litres, worth 5,703.2 million USD. It accounted for 77.1% and 39.7% of the total beverage sales in Thailand in terms of volume and value, respectively. The main products are bottled and mineral water, with a combined sales volume of 5,008.8 million litres, accounting for 53.7% of the non-alcoholic beverage sales volume. The following are the other products in order of sales volume: soft drinks and soda (31.1%), ready-to-drink tea (4.3%), fruit juice (3.5%), energy drinks (3.2%), and other beverages (4.2%).

Alcoholic beverages

The domestic sales volume of alcoholic beverages was 2,777.6 million litres, worth 8,660.1 million USD. It accounted for 22.9% and 60.3% in terms of volume and value of the total beverage sales in Thailand, respectively. The main product is beer, with a sales volume of 2,017.1 million litres, accounting for 72.6% of the alcoholic beverage sales volume. The following are the other products in order of sales volume: liquor (25.5%), ready-to-drink alcoholic beverages (0.9%), wine (0.9%), and fermented or matured fruit juice (0.1%).

Key Highlights

- The Thai beverage industry is dominated by non-alcoholic beverages, accounting for 77% of the total beverage sales volume in 2022.

- Bottled water and mineral water is Thailand’s most popular non-alcoholic beverage, accounting for 53.7% of the non-alcoholic beverage sales volume in 2022.

- Beer is the most popular alcoholic beverage in Thailand, accounting for 72.6% of the alcoholic beverage sales volume in 2022.

Export of beverages from Thailand

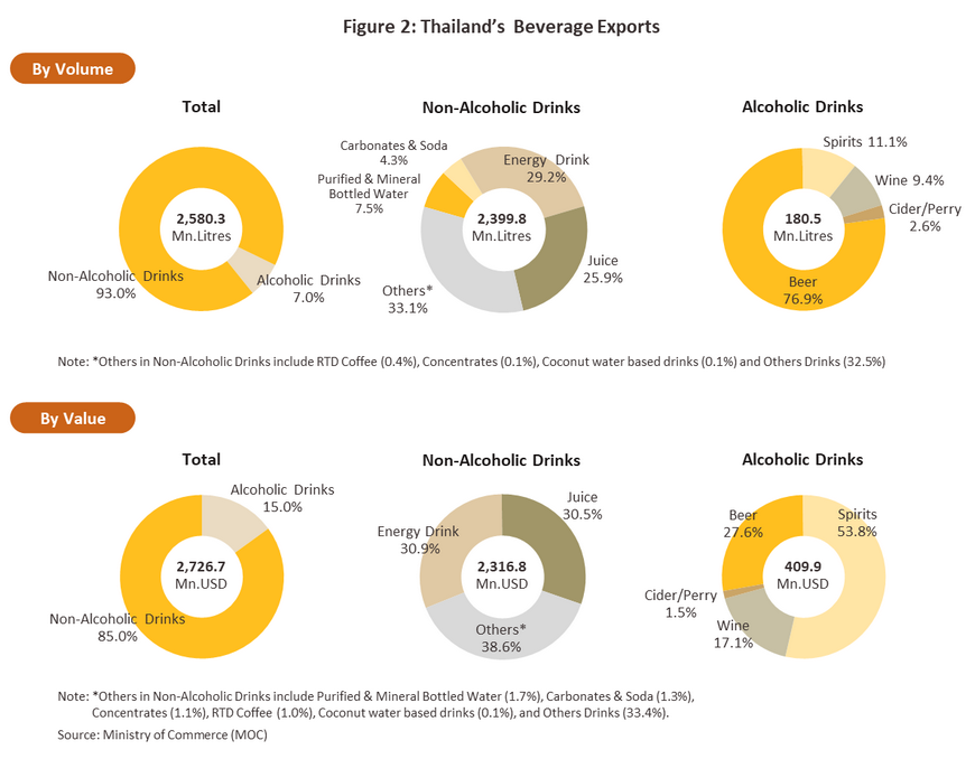

In 2023, Thailand exported 2,580.3 million litres of beverages worth US$2.726.7 billion (Figure 2). Cambodia was the top export destination, accounting for 21.2% of the volume, followed by Vietnam (15.1%), Myanmar (12.5%), the United States (12.3%), and China (6.2%).

Exports were divided into two categories:

- Non-alcoholic beverages accounted for 93.0% of the volume and 85.0% of the value. Cambodia was the top export destination, accounting for 22.2% of non-alcoholic beverage exports. Vietnam (16.2%), the United States (13.1%), Myanmar (9.6%), and China (6.6%) followed.

- Alcoholic beverages accounted for 7.0% of the volume and 15.0% of the value. Myanmar was the top export destination, accounting for 49.4% of alcoholic beverage exports. The United States (12.7%), Cambodia (10.4%), Japan (5.1%), and the Philippines (2.3%) followed.

Summary

The Thai beverage industry is an important contributor to the country’s economy. In 2023, the industry generated a total export value of US$2.726.7 billion, accounting for 2.7% of GDP. Non-alcoholic beverages accounted for 85.0% of the export value, while alcoholic beverages accounted for 15.0%.

Key takeaways

- Cambodia is the top export destination for Thai beverages in terms of volume and value.

- Non-alcoholic beverages are the main export product, accounting for 93.0% of the volume and 85.0% of the value.

- Myanmar is the top export destination for Thai alcoholic beverages, accounting for 49.4% of the volume.

Development and Structure of the Beverage Industry in Thailand

The commercial production of beverages in Thailand initially involved the production of alcoholic beverages by the government to replace imports. In the following period, the government opened up opportunities for private investors to produce alcoholic beverages, and the Board of Investment (BOI) continued to promote investment in the beverage industry. As a result, the beverage industry in Thailand expanded and was able to produce a variety of beverages, both alcoholic and non-alcoholic. The key developments in the Thai beverage industry are as follows:

Non-alcoholic beverages

In the early days, the industry was dominated by foreign investors, such as Coca-Cola and POLARIS, which were established in 1949 and 1950, respectively. As non-alcoholic beverages became more popular in the domestic market, the Thai government issued policies to promote investment in this sector. These included the Industrial Promotion Act of 1950, designed to promote the production of non-alcoholic beverages for domestic consumption, and the promotion of exports during the Third National Economic Development Plan (1972-1976). Taking advantage of Thailand’s competitive labour costs and diverse agricultural raw materials, especially for producing fruit juices, the industry attracted significant investment from both Thai and foreign investors. As a result, the industry was able to meet the growing demand of the domestic and export markets.

Under the Factories Act of 1992, non-alcoholic beverage manufacturing plants in Thailand are classified by the number of employees and production capacity. The following table shows the different categories and requirements:

Current Structure of the Non-Alcoholic Beverage Industry in Thailand

The non-alcoholic beverage industry in Thailand is a diverse sector with a wide range of products. The structure of production and marketing varies by product type.

Bottled water and mineral water industry

This industry was initially capital-intensive, but machinery and water filtration technology development has led to lower capital and unit production costs. This has made it easier for new entrants to enter the market. Some companies also produce bottled water for other brands or businesses, such as hotels and hospitals. They may also produce other beverages, such as carbonated soft drinks, alcohol, beer, and fruit juice. This gives them an advantage in expanding their marketing channels.

The leading bottled water and mineral water producers in Thailand include:

- Thai Beverage Public Company Limited (Crystal and Chang brands)

- Boon Rawd Brewery Company Limited (Singha brand)

- Nestle (Thailand) Limited (Nestle Pure Life brand)

- Coca-Cola (Thailand) Company Limited (Namthip brand)

- Suntory PepsiCo Beverage (Thailand) Company Limited (Aquafina brand)

In 2023, these producers had a combined market share of 57.6% of Thailand’s total bottled water and mineral water market. They sell their products through retail stores, modern trade, restaurants, online channels, and direct sales (home and office delivery). Local brands also focus on the provincial market and sold in general stores and restaurants.

Carbonated soft drink industry

This industry is an oligopoly with a small number of dominant players. It is difficult for new entrants to enter the market because it requires a high investment in machinery (fixed costs). Producers must operate at a scale that achieves economies of scale and import concentrate from their parent companies.

The leading carbonated soft drink producers in Thailand include:

- Coca-Cola (Thailand) Company Limited (Coca-Cola, Fanta, Sprite, and Schweppes brands)

- Suntory PepsiCo Beverage (Thailand) Company Limited (Pepsi, Mirinda, and 7Up brands)

- Thai Beverage Public Company Limited (S brand)

- Ajethai Company Limited (Big brand)

In 2023, these producers had a combined market share of more than 98.4% of the total carbonated soft drink market.

Other non-alcoholic beverage industries

The other non-alcoholic beverage industries, such as fruit juice, tea, coffee, and dairy products, are also diverse with various players. The structure of production and marketing varies by product type and market segment.

Current Structure of the Alcoholic Beverage Industry in Thailand

The alcoholic beverage industry in Thailand has a long history, dating back to the production of local liquors and fermented beverages in the early 20th century. The government initially monopolised the production and distribution of alcoholic beverages, but this was gradually liberalised in the late 20th century.

Beer Industry

The beer industry is the largest segment of the alcoholic beverage industry in Thailand. The current regulations have relaxed the requirements for setting up a brewery, making it easier for new entrants to enter the market. The leading beer producers in Thailand are:

- Boon Rawd Brewery Company Limited (Leo, Singha, Snowy Weissen, and U Beer brands)

- Thai Beverage Public Company Limited (Chang, Arsa, and Federbrau brands)

- Heineken Thailand Company Limited (Heineken brand)

In 2023, these producers had a combined market share of more than 95.7% of the total beer market.

Spirits industry

The spirits industry is the second largest segment of the alcoholic beverage industry in Thailand. The current regulations have also relaxed the requirements for setting up a distillery, but some spirits are still subject to minimum production requirements. The leading spirits producers in Thailand are:

- Thai Beverage Public Company Limited (Rungkhao, Hongthong, and Blend 285 brands)

- Diageo Moet Hennessy (Thailand) Limited (Johnnie Walker, Smirnoff, and Benmore brands)

- Regency Brandy Thai Company Limited (Regency brand)

In 2023, these producers had a combined market share of more than 71.2% of the total spirits market.

Other alcoholic beverage industries

The other alcoholic beverage industries, such as wine, whiskey, and rum, are significant players in the Thai market. The structure of these industries varies by product type and market segment.

Key challenges

The alcoholic beverage industry in Thailand faces several challenges, including:

- Government regulations. The government imposes several regulations on producing, distributing, and advertising alcoholic beverages. These regulations can be burdensome for businesses, especially small and medium-sized enterprises.

- Social attitudes. There is a growing awareness of the health risks associated with alcohol consumption. This is leading to a decline in demand for alcoholic beverages, particularly among young people.

- Competition. The alcoholic beverage industry is highly competitive, with a small number of large companies dominating the market. This can make it difficult for new entrants to compete.

Despite these challenges, the alcoholic beverage industry is still a major contributor to the Thai economy. The industry is expected to grow in the coming years, driven by rising incomes and urbanisation.

Past Situation

Production of Beverages in Thailand

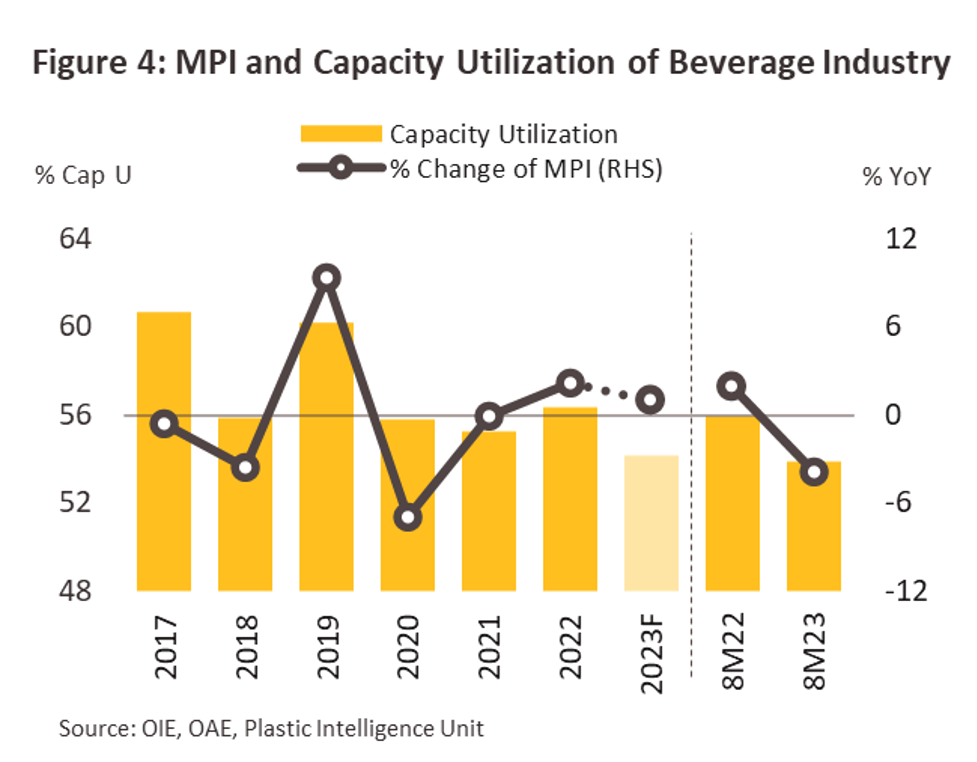

The production situation has been quite volatile in the past. In 2022, the production index of the Thai beverage industry increased by +2.1% before declining by -3.9% YoY in the first 8 months of 2023. It is estimated that production for the whole year of 2023 is likely to remain flat or increase by 0.0-2.0% (Figure 4). By product type, the situation can be summarised as follows:

Non-Alcoholic Beverages

Non-alcoholic beverages account for most of the Thai beverage market, with a share of over 70%. The production of non-alcoholic beverages increased by +2.7% in 2022 before declining by -2.7% YoY in the first 8 months of 2023. The decline was mainly due to the COVID-19 pandemic, which decreased demand for beverages in restaurants and other food service establishments.

Bottled and mineral water production, the largest non-alcoholic beverage market segment, increased by +2.8% in 2022 before declining by -2.5% YoY in the first 8 months of 2023. The decline was mainly due to the same factors as for non-alcoholic beverages.

The production of carbonated soft drinks, the second largest segment of the non-alcoholic beverage market, increased by +2.6% in 2022 before declining by -2.8% YoY in the first 8 months of 2023. The decline was mainly due to increasing competition from local brands and the growing popularity of healthier beverages.

Alcoholic Beverages

Alcoholic beverages account for the remaining 30% of the Thai beverage market. The production of alcoholic beverages increased by +1.8% in 2022 before declining by -4.6% YoY in the first 8 months of 2023. The decline was mainly due to the COVID-19 pandemic, which decreased social gatherings and consumption of alcoholic beverages.

The beer production, the largest segment of the alcoholic beverage market, increased by +2.0% in 2022 before declining by -4.8% YoY in the first 8 months of 2023. The decline was mainly due to the same factors as for alcoholic beverages.

The production of spirits, which is the second largest segment of the alcoholic beverage market, increased by +1.6% in 2022 before declining by -4.4% YoY in the first 8 months of 2023. The decline was mainly due to the same factors as for alcoholic beverages.

Non-alcoholic beverages:

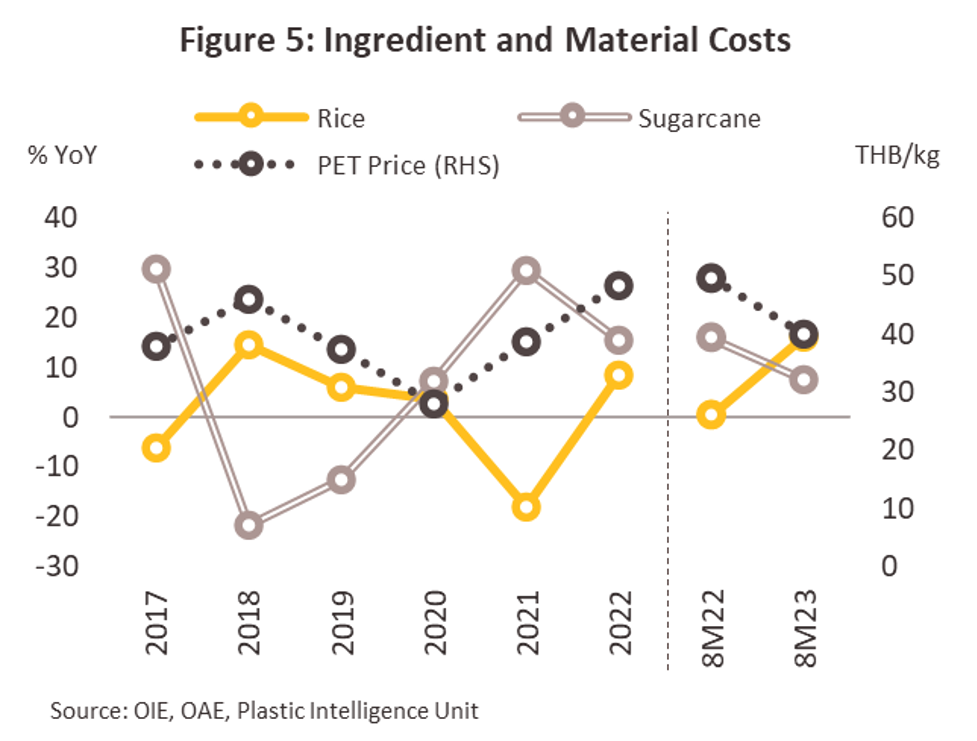

The main products include bottled pure and mineral water, carbonated soft drinks and soda, and energy and sports drinks. In 2022, the production index of this product group increased by +0.4%. The main driver was the increase in demand following the reopening of the country and the gradual recovery of economic activities, even though businesses faced supply pressures from production costs due to oil prices, especially packaging costs, as well as energy costs used in production and transportation.

For the first 8 months of 2023, production declined by -2.9% YoY. This was mainly due to the decline in the production of energy drinks and sports drinks (-13.9% YoY) and fruit-flavoured beverages (-5.1% YoY), which are beverages that use sugar as a primary ingredient and are affected by the increase in sugar tax under the new tax structure that came into effect in April 2023.

However, the overall production of non-alcoholic beverages in Thailand is expected to remain flat or grow by 0.0-2.0% in 2023. This is supported by the products of bottled pure water and mineral water, carbonated soft drinks and soda, from the recovering demand and the use of sweeteners instead of sugar by businesses.

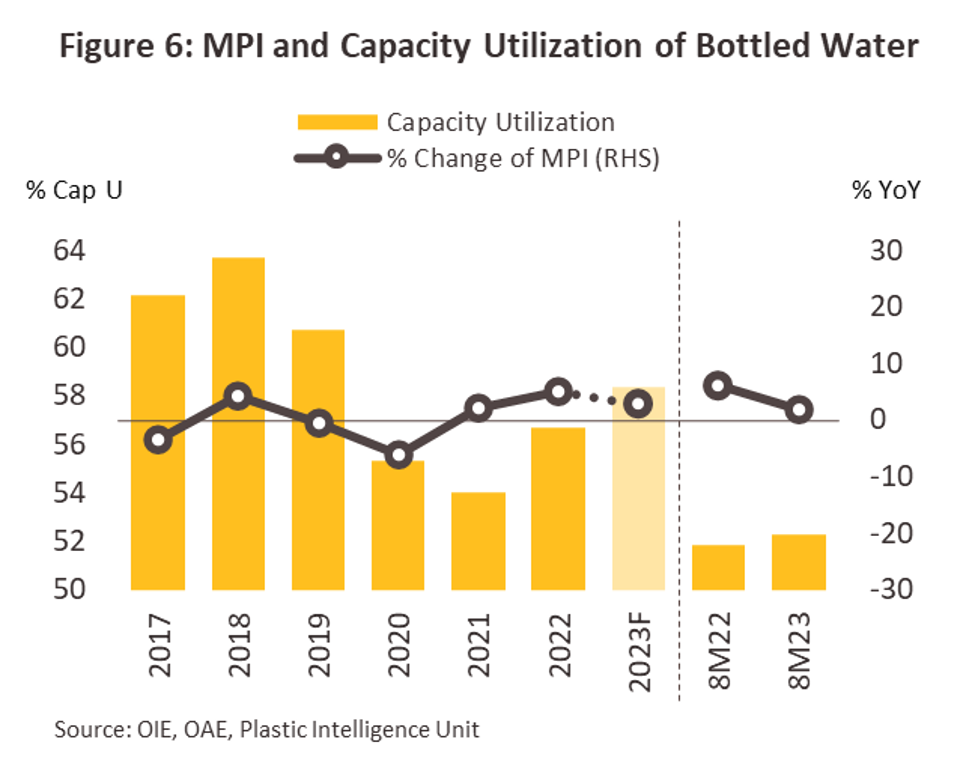

Bottled water and mineral water:

In 2022, the production index increased by +5.2% and grew by +1.8% YoY in the first 8 months of 2023. This is to support the higher demand following the recovery of economic activities. Additionally, some producers rush to produce to stock up on goods due to the El Niño phenomenon, which is expected to become more severe and could affect water supply and lead to higher water costs. It is estimated that bottled and mineral water production for 2023 will increase by 2.0-3.0%.

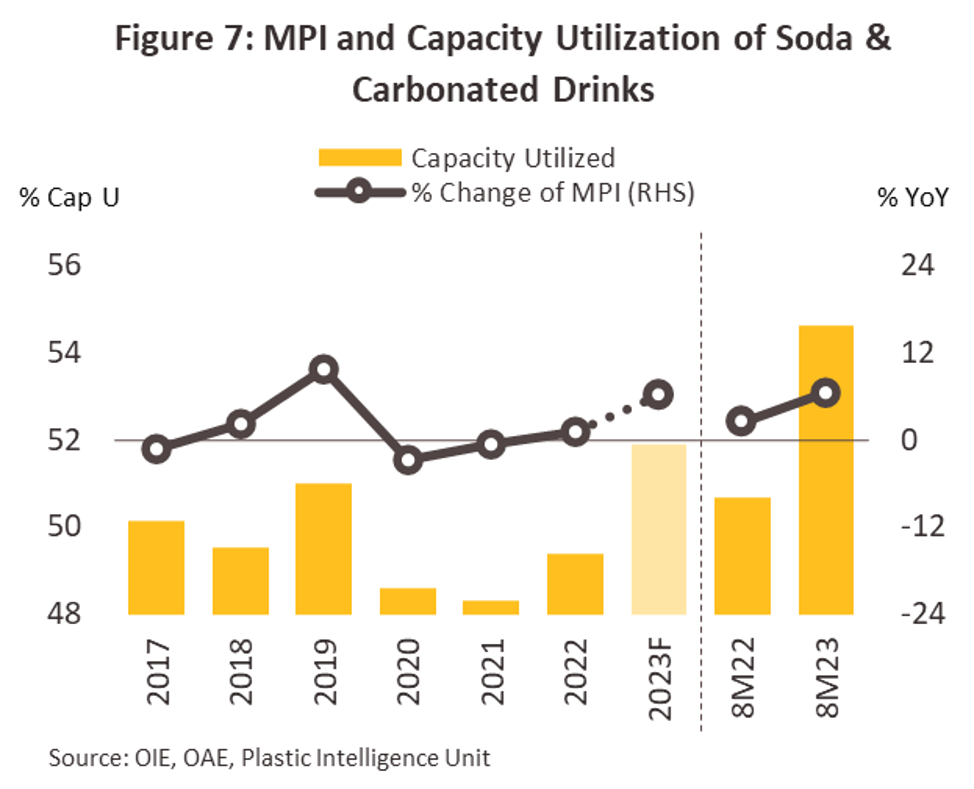

Carbonated soft drinks and soda:

In 2022, the production index increased by +1.1% and expanded to +6.4% YoY in the first 8 months of 2023. This is due to the continuous recovery of restaurants and entertainment venues, supporting the recovery of the tourist group. As a result, businesses are rushing to produce to meet market demand. Additionally, the direction of packaging costs (plastic pellets and aluminium) has declined. At the same time, the price of sugar and the increased sugar tax have had a relatively limited impact due to the adaptation of soft drink producers to switch to sweeteners instead of sugar. The production of carbonated soft drinks and soda for 2023 is estimated to increase by 5.5-6.5%.

Key takeaways:

- The production of non-alcoholic beverages in Thailand declined in the first 8 months of 2023, mainly due to the decline in the production of energy drinks, sports drinks and fruit-flavored beverages, which are affected by the increase in sugar tax.

- However, it is expected that the overall production of non-alcoholic beverages in Thailand will remain flat or grow by 0.0-2.0% in 2023, supported by the products of bottled pure water and mineral water, carbonated soft drinks and soda, from the recovering demand and the use of sweeteners instead of sugar by businesses.

Specific highlights:

- The production of bottled water and mineral water is expected to grow by 2.0-3.0% in 2023, supported by the recovering demand and the rising popularity of healthy beverages.

- The production of carbonated soft drinks and soda is expected to grow by 5.5-6.5% in 2023, supported by the recovering demand and the use of sweeteners instead of sugar by businesses.

Alcoholic beverages:

The main products in this group include beer and liquor. In 2022, production expanded by +9.0% before falling to -4.9% YoY in the first 8 months of 2023. It is estimated that overall production for 2023 will contract by (-4.0)-(-5.0)%.

Beer:

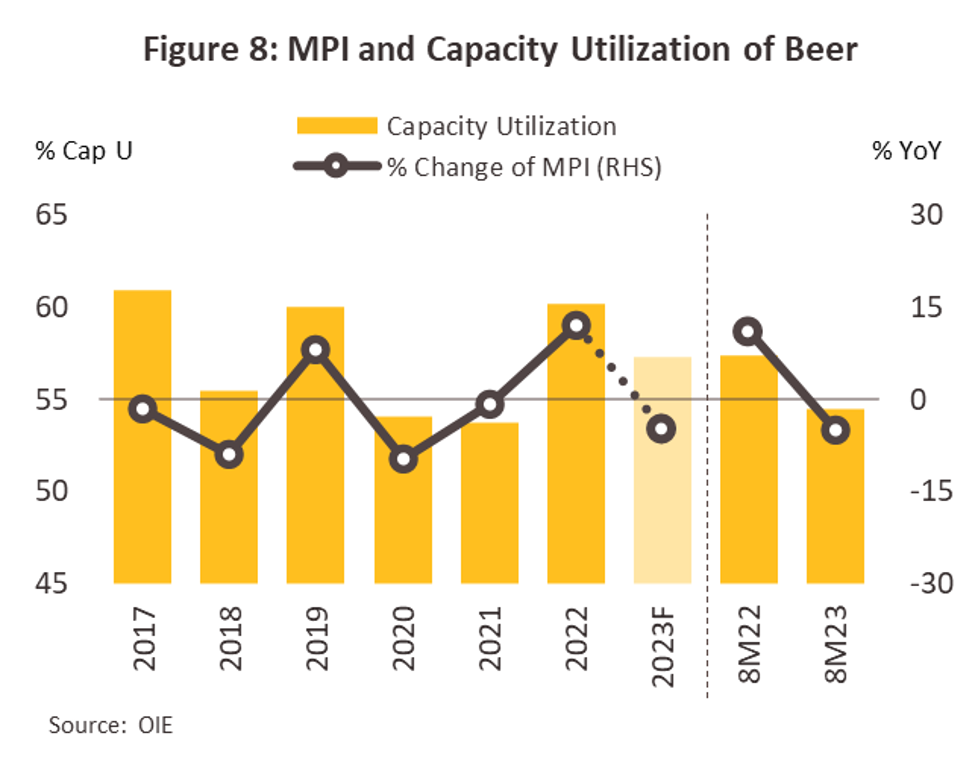

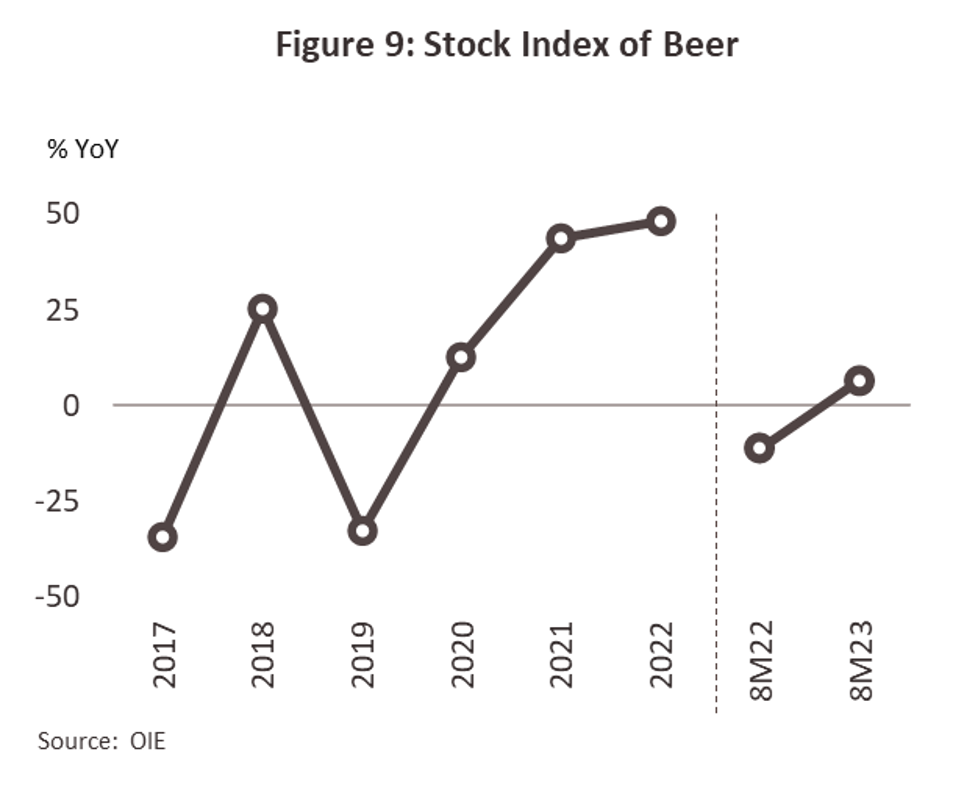

In 2022, the production index increased by +12.1% to support the recovery of recreational activities as the economy began to pick up, especially the country’s reopening to welcome the gradual arrival of foreign tourists. Producers have adapted their businesses to support tax measures by adjusting the formula of their beverages to reduce the degree of alcohol content. However, in the first 8 months of 2023, production fell by -5.0% YoY (Figure 8) due to an increase in the cost of imported malt by +36.0% YoY, and producers gradually reduced production to clear their stock (destocking) after having ramped up production significantly in 2022 (Figure 9). Beer production in 2023 is estimated to fall by (-4.5)-(-5.0)%.

Liquor:

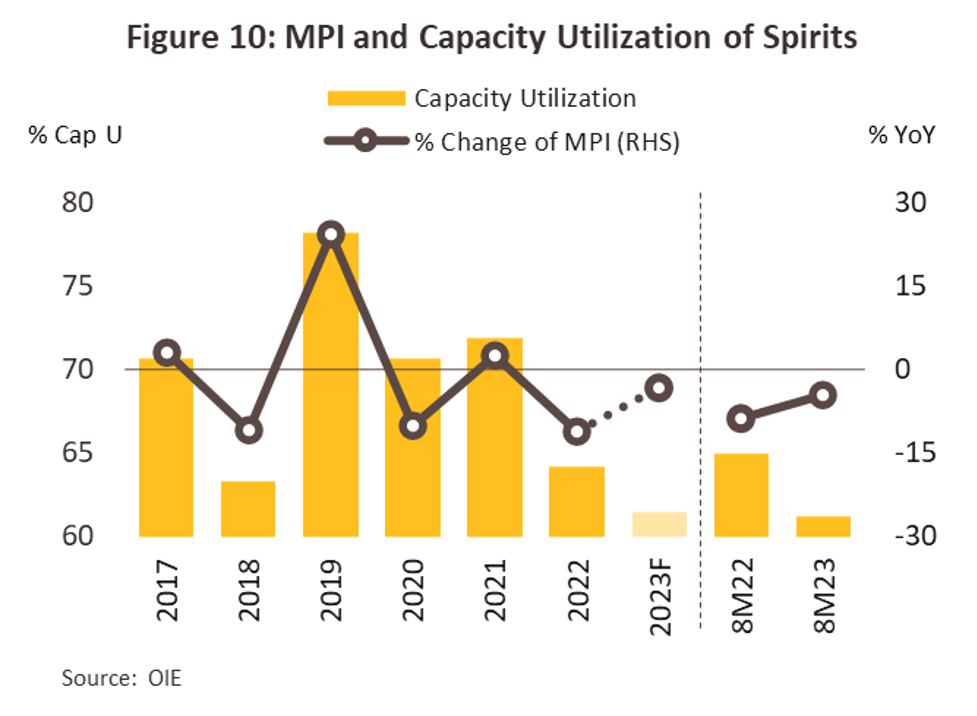

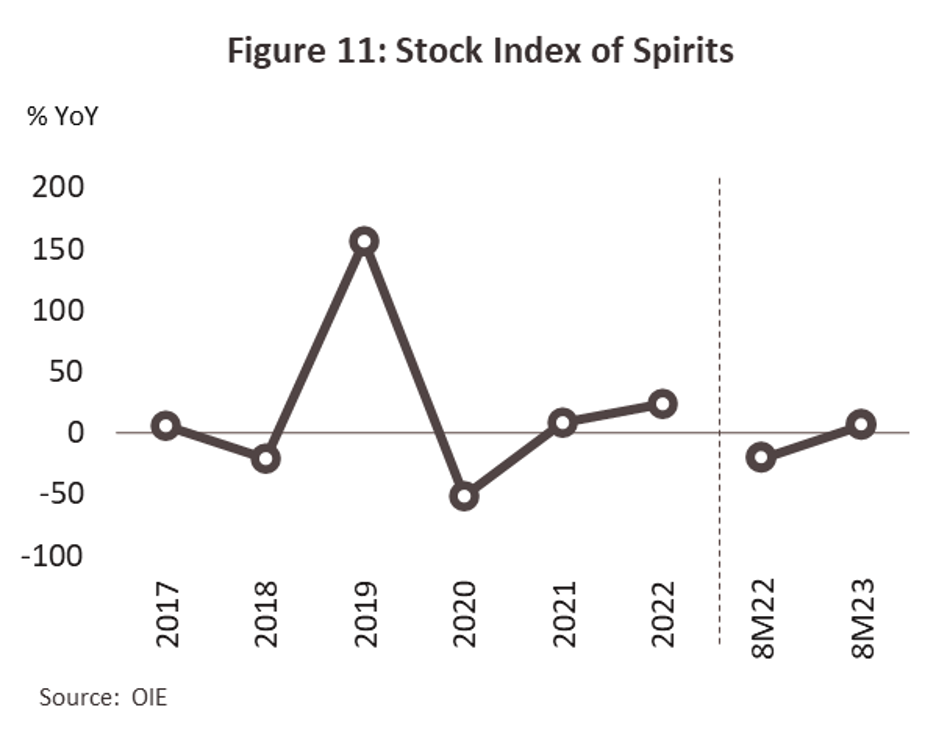

In 2022, the production index contracted by -11.1% due to rising raw material costs, such as molasses (+2.0%) and ethanol (+7.6%), which were a result of higher sugarcane prices (+15.6%). Production continued to decline by -4.7% YoY in the first 8 months of 2023 (Figure 10) due to rising agricultural raw material prices, such as sugarcane (+7.6% YoY) and glutinous rice (+16.1% YoY).

In addition, inventory began to increase following the contraction of luxury goods sales affected by the cost of living, resulting in businesses slowing down production to clear their stock (Figure 11). It is estimated that liquor production for 2023 will contract by (-3.0)-(-4.0)%.

Key takeaways:

- The production of alcoholic beverages in Thailand declined in the first 8 months of 2023, mainly due to increased production costs, such as the cost of imported malt and agricultural raw materials, as well as the destocking of goods by businesses.

- It is estimated that overall production of alcoholic beverages in Thailand will contract by (-4.0)-(-5.0)% in 2023.

Specific highlights:

- The beer production is expected to fall by (-4.5)-(-5.0)% in 2023, mainly due to increased imported malt costs and the destocking of goods by businesses.

- The production of liquor is expected to fall by (-3.0)-(-4.0)% in 2023, mainly due to the rising cost of agricultural raw materials and the destocking of goods by businesses.

Here are some additional details about the key takeaways:

- The increase in production costs: The cost of imported malt, a key ingredient in beer, rose by +36.0% YoY in the first 8 months of 2023. This was due to the global shortage of malt, exacerbated by the war in Ukraine. The cost of other agricultural raw materials, such as sugarcane and glutinous rice, also rose in Thailand.

- The destocking of goods: Businesses in the alcoholic beverages industry are destocking goods to reduce inventory levels. This is due to the rising cost of living, leading to declining demand for luxury goods, such as alcoholic beverages.

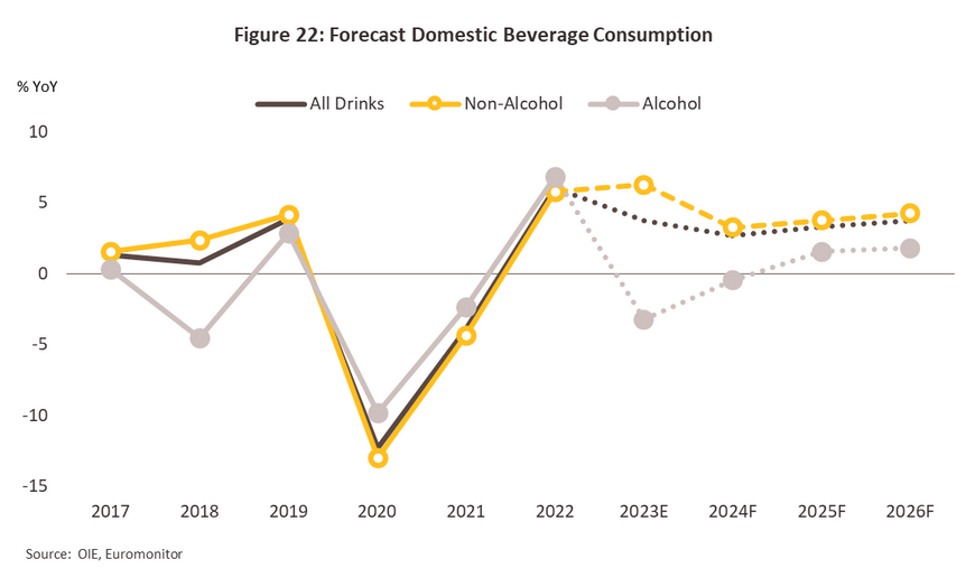

Domestic beverage sales

In 2022, the total volume of beverage sales of all types in Thailand increased by +6.1%. This was due to the relaxation of COVID-19 measures, which led to the economy’s and various businesses’ gradual recovery. Restaurants, pubs, and bars could reopen, and people could eat out as usual. This allowed products to have more distribution channels and reach more consumers.

For the first 8 months of 2023, domestic sales continued to increase by +6.7% YoY. The main driver was the prolonged hot weather, which increased demand for refreshing beverages. The tourism industry also continued to recover. The total volume of beverage sales in Thailand in 2023 is estimated to grow by 3.5-4.0%.

The demand for beverage products in Thailand can be classified as follows:

Non-alcoholic beverages:

In 2022, the volume of sales expanded by +5.8%. This was in line with the gradual return to normal economic activities. In the first 8 months of 2023, sales grew by +10.2% YoY. This was driven by the continued factors from the previous year, especially the services sector, including restaurants, hotels, and tourism. These factors are expected to continue to affect the market throughout 2023. It is estimated that the volume of non-alcoholic beverage sales will grow by 5.5-6.5%.

The main products in this group are:

- Bottled water and mineral water:

In 2022, the volume of sales increased by +6.5%. This was due to:

* Concerns about the ongoing pandemic led consumers to be more concerned about health and safety and to choose to consume beverages with safe packaging.

* The recovery of economic activities and tourism.

* Population growth and urbanisation, driven by infrastructure investment projects and mass transit connecting suburban areas (conglomeration).

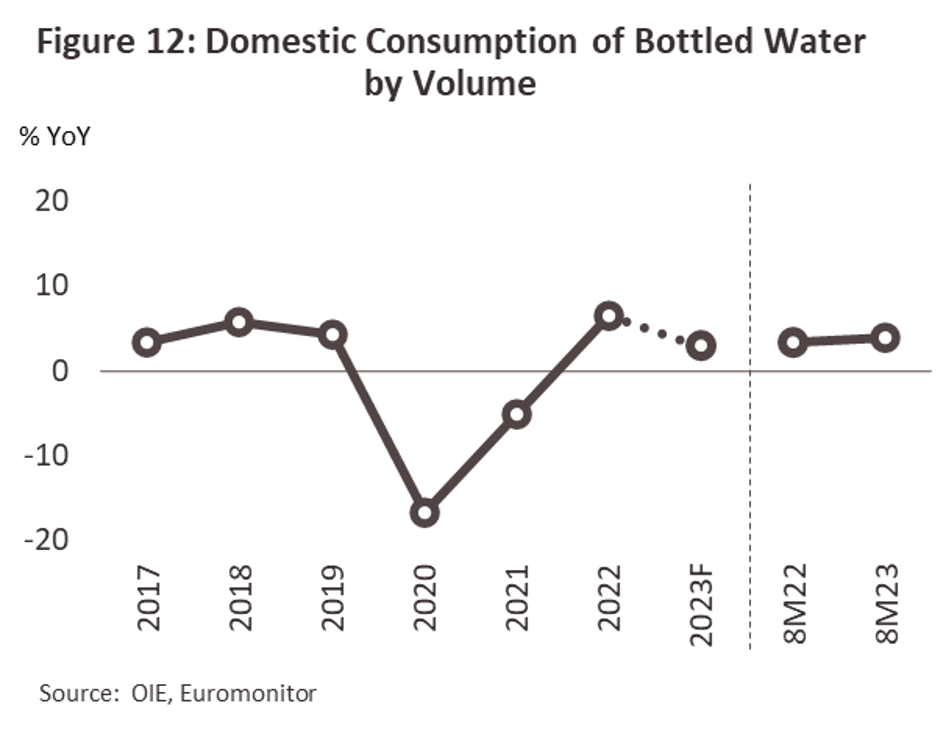

For the first 8 months of 2023, sales grew by +3.9% YoY (Figure 12). This was due to the positive factors that continued from the previous year, rising temperatures from heat waves and the onset of the El Niño phenomenon. The bottled water and mineral water market is expected to continue to grow. The volume of bottled and mineral water sales in 2023 is expected to increase by 2.5-3.0%.

- Soda and carbonated drinks:

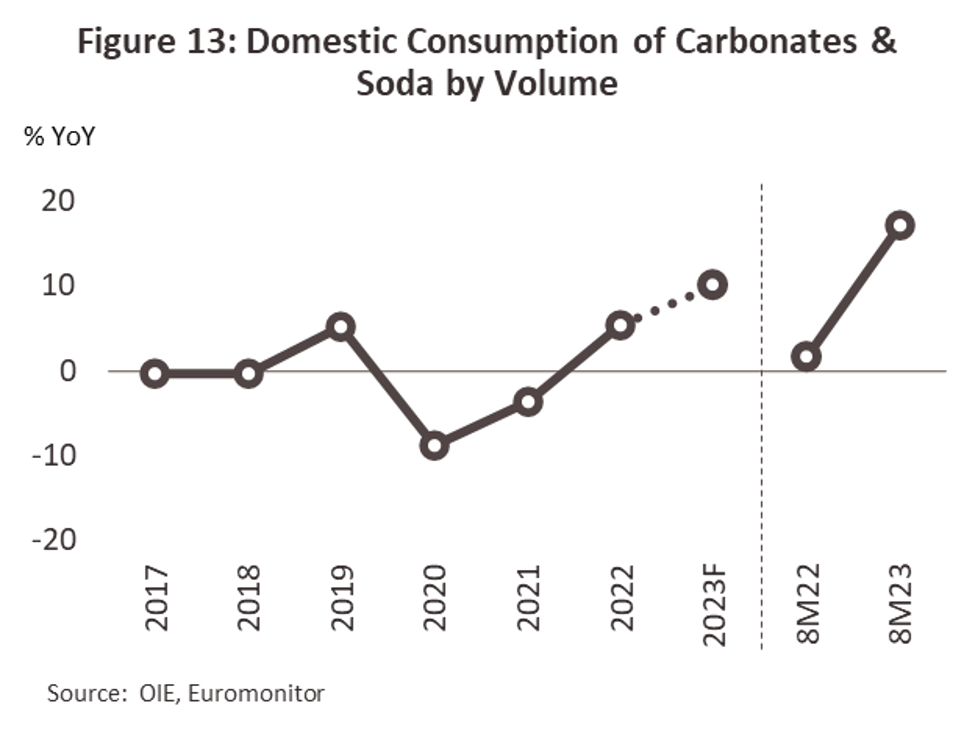

In 2022, the volume of sales increased by +5.4%. This was due to the economic recovery after the relaxation of strict measures to control the pandemic, which supported the recovery of restaurants, pubs, bars, and entertainment venues. Beverage manufacturers also improved their products to offer various options, particularly sugar-free or low-sugar formulas, to meet the healthy lifestyle trend.

For the first 8 months of 2023, sales grew by +17.1% YoY (Figure 13). In addition to the support of restaurants and entertainment venues and rising temperatures, a portion of the demand also came from stores or distributors through other channels that wanted to stock up on goods before soft drink manufacturers raised prices in response to rising costs. As a result, the sales volume of soda and carbonated drinks in 2023 is expected to increase by 9.0-11.0%.

Key takeaways:

- The overall beverage sales volume in Thailand is expected to grow by 3.5-4.0% in 2023.

- The volume of sales of non-alcoholic beverages is expected to grow by 5.5-6.5%, led by bottled water, mineral water, soda, and carbonated drinks.

- The volume of sales of alcoholic beverages is expected to decline by (-4.0)-(-5.0)%, led by beer and liquor.

Alcoholic beverages:

In 2022, the volume of sales expanded by +6.9%. This was due to the reopening of the country and the recovery of the tourism industry, which supported the return of businesses related to alcoholic beverages, such as pubs, bars, and entertainment venues. However, for the first 8 months of 2023, the volume of sales contracted by -4.0% YoY. This was due to the high cost of living, which eroded purchasing power, leading consumers to reduce their consumption of luxury goods amid a growing trend of consumers becoming more health-conscious. It is estimated that the sales volume of alcoholic beverages for 2023 will decline by (-3.0)-(-3.5)%.

The main products in this group are:

- Beer:

In 2022, the volume of sales increased by +9.9%. This was due to increased distribution channels after restaurants, pubs, and bars resumed normal service. At the same time, beer products were developed to provide more choices for consumers, such as alcohol-free beer, fruit-flavoured beer, ale beer, and lager beer. For the first 8 months of 2023, the volume of sales contracted by -4.2% YoY (Figure 14). This was due to the impact of price increases in line with rising raw material costs, while consumer purchasing power remained weak. It is estimated that beer sales volume for the whole year of 2023 will decline by (-3.0)-(-4.0)%.

- Liquor:

In 2022, the volume of sales decreased by -1.0%. This was due to the changing behaviour of consumers who prefer lower-proof alcoholic beverages. Some consumers turned to beer, a substitute product with various new flavours to try. For the first 8 months of 2023, the sales volume continued to contract by -1.9% YoY (Figure 15). This was due to manufacturers raising prices in line with rising costs and some consumers reducing their consumption of alcoholic beverages following a growing health awareness campaign. It is estimated that the volume of liquor sales in 2023 will decline by (-1.0)-(-2.0)%.

Key takeaways:

- The overall volume of alcoholic beverage sales in Thailand is expected to decline by (-3.0)-(-3.5)% in 2023.

- The beer sales volume is expected to decline by (-3.0)-(-4.0)%, led by price increases and weak consumer purchasing power.

- The volume of liquor sales is expected to decline by (-1.0)-(-2.0)%, led by the changing behaviour of consumers and the increasing awareness of health issues.

Exports of Thai beverages

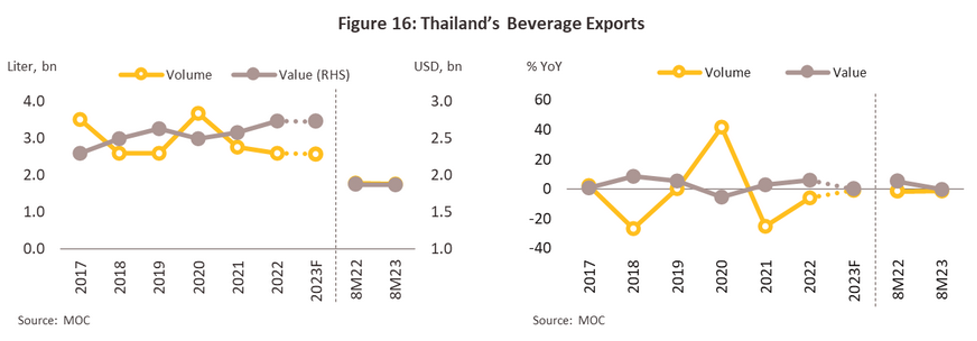

In 2022, the volume of exports of Thai beverages was 2.6 billion litres (-6.4%), while the value of exports was USD 2.7 billion (+6.0%) (Figure 16). The decline in the volume of exports was mainly due to liquor (-15.3%) and soda and carbonated drinks (-39.7%).

For the first 8 months of 2023, the volume of exports contracted slightly by -1.2% YoY and the value of exports contracted by -0.1% YoY. This was due to the continued weak purchasing power and the depreciation of the currencies of neighbouring major trading partners, such as Cambodia and Myanmar. It is estimated that the volume of exports of Thai beverages in 2023 will contract by (-0.5)-(-1.5)%.

By major product

- Liquor: In 2022, the volume of exports of liquor contracted by -15.3% YoY to 1.1 billion litres. This was due to the changing behaviour of consumers who prefer lower-proof alcoholic beverages, as well as the impact of the COVID-19 pandemic on tourism. For the first 8 months of 2023, the volume of exports of liquor continued to contract by -11.9% YoY to 726 million liters. This was due to the continued weak purchasing power and the depreciation of the currencies of neighbouring countries.

- Soda and carbonated drinks: In 2022, the volume of exports of soda and carbonated drinks contracted by -39.7% YoY to 800 million litres. This was due to the impact of the COVID-19 pandemic on tourism and the competition from other countries in the region. For the first 8 months of 2023, the volume of exports of soda and carbonated drinks continued to contract by -25.9% YoY to 524 million litres. This was due to the continued weak purchasing power and the depreciation of the currencies of neighbouring countries.

- Bottled water and mineral water: In 2022, the volume of exports of bottled water and mineral water expanded by +1.8% YoY to 600 million litres. This was due to the region’s increasing demand for bottled and mineral water. For the first 8 months of 2023, bottled and mineral water exports expanded by +2.7% YoY to 428 million litres. This was due to the continued growth of the tourism industry and the increasing demand for healthy beverages.

- Other beverages: In 2022, the volume of exports of other beverages expanded by +11.1% YoY to 500 million litres. This was due to the increasing demand for Thai beverages in the region. For the first 8 months of 2023, the volume of exports of other beverages continued to expand by +8.7% YoY to 388 million litres. This was due to the continued growth of the tourism industry and the increasing demand for Thai beverages.

Overall, the export of Thai beverages is expected to contract by (-0.5)-(-1.5)% in 2023. This is due to the continued weak purchasing power and the depreciation of the currencies of neighbouring countries.

Non-alcoholic beverages:

In 2022, the volume of exports of non-alcoholic beverages contracted by -6.9%, while the value of exports expanded by +2.5%. The decline in the volume of exports was mainly due to soda and carbonated drinks, particularly in Myanmar, which is still facing economic problems and a policy banning the import of certain beverage products. For the first 8 months of 2023, the volume of exports contracted by -0.3% YoY and the value of exports contracted by -0.3% YoY. It is estimated that the volume of exports will grow by 0.0-2.0% in 2023.

Bottled water and mineral water:

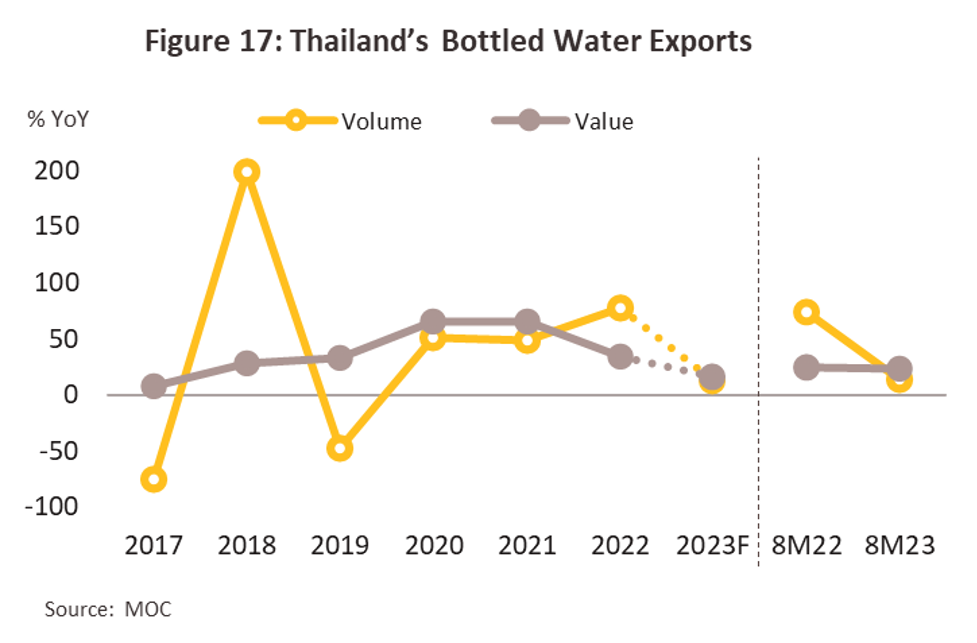

In 2022, exports of bottled water and mineral water increased by +77.1% in terms of volume and +34.3% in terms of value. This was due to the expansion of exports in both major markets, including Cambodia (+68.5%) and China (+53.0%), which together account for more than 68% of the volume of bottled water and mineral water exports from Thailand. Exports also expanded to other neighbouring countries, such as Laos (+54.4%), Myanmar (+429.1%), and Vietnam (+55.1%), from the reopening of cross-border trade.

For the first 8 months of 2023, bottled and mineral water exports expanded by +14.0% YoY in volume and +23.6% YoY in value (Figure 17). The volume of exports expanded well in Cambodia (+6.8%), China (+53.7%), and Laos (+66.1%), from the reopening of border trade checkpoints, the addition of new border checkpoints, and China’s relaxation of import inspection measures. This was coupled with the market’s confidence in the quality of bottled and mineral water products imported from Thailand. It is estimated that the volume of exports will increase by 10.0-12.0% in 2023.

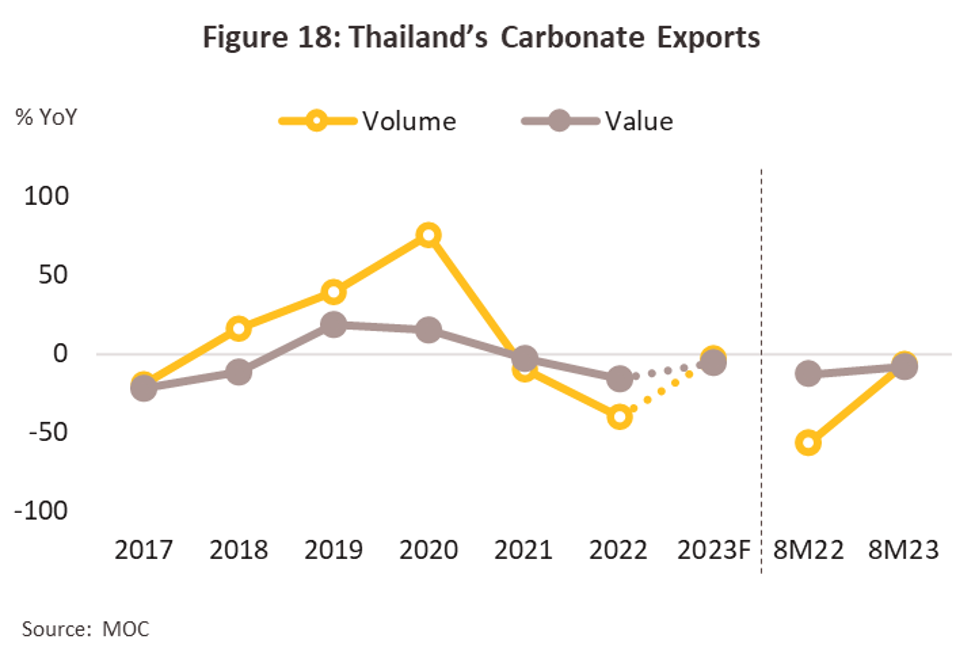

Soda and carbonated drinks:

In 2022, exports of soda and carbonated drinks contracted by -39.7% in volume and -15.5% in value. This was mainly due to the contraction of the Myanmar market (-16.4%) from the ban on the import of certain beverages from all countries via land transportation. Malaysia also contracted (-60.7%) from the decline in demand for stockpiling goods after the risks to food security and the disaster began to ease.

For the first 8 months of 2023, the volume of exports contracted by -6.4% YoY and the value decreased by -7.5% YoY (Figure 18). The decline in exports was due to the contraction of exports to Myanmar (-11.4% YoY) and Laos (-33.4% YoY). These trading partners still face ongoing economic and political problems within their countries. Inflation and a weak exchange rate have compounded the weakening of purchasing power, leading consumers to be more cautious with their spending on non-essential beverages. It is estimated that the volume of exports will decrease by (-2.0)-(-3.0%) in 2023.

Key takeaways:

- The overall volume of exports of non-alcoholic beverages in Thailand is expected to grow by 0.0-2.0% in 2023.

- The growth of bottled and mineral water exports is expected to continue, driven by the increasing demand for these products in the region.

- The decline in soda and carbonated drinks exports is expected to continue due to the ongoing economic and political problems in Myanmar and Laos.

Alcoholic beverages:

In 2022, exports of alcoholic beverages expanded by +7.1% in terms of volume and +31.5% in terms of value. This was due to the easing of the COVID-19 pandemic in neighbouring countries, which allowed key trading partners, such as Myanmar and Cambodia (accounting for 53.3% and 7.6% of the total volume of Thai alcoholic beverage exports), to reopen border checkpoints, which are the main channels for exporting these products from Thailand.

For the first 8 months of 2023, exports contracted by -11.9% YoY in volume and +1.1% YoY in value. It is estimated that the volume of exports of alcoholic beverages from Thailand will contract by (-10.0)-(-11.0)% in 2023.

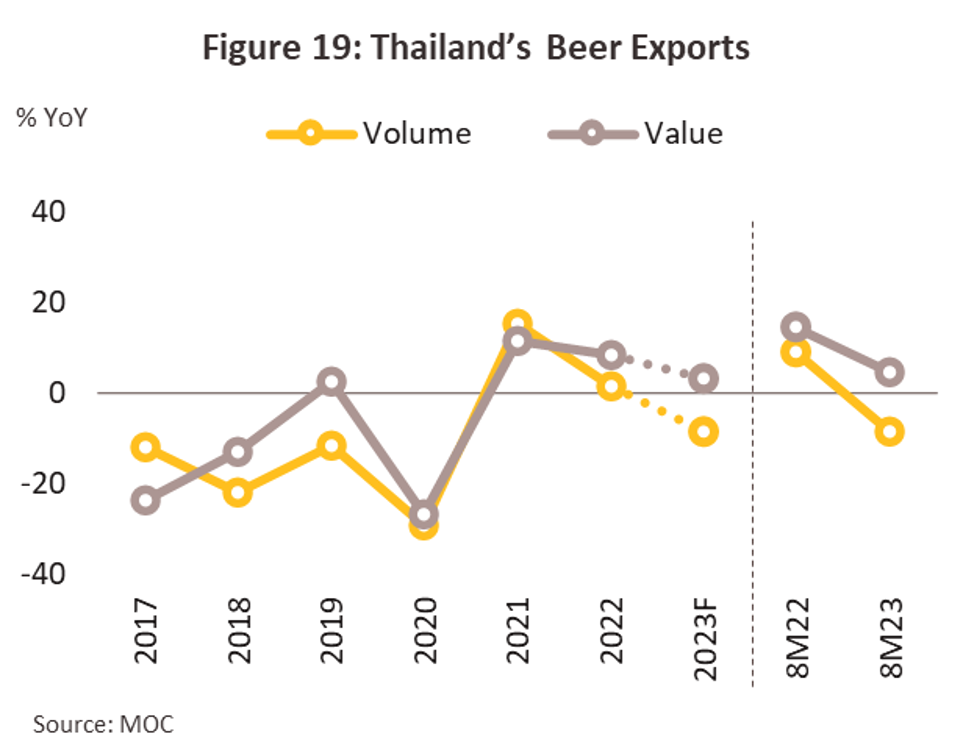

Beer:

In 2022, beer exports increased by +1.5% in volume and +8.5% in value. As usual, the volume of exports expanded from Myanmar (+20.8%) and Cambodia (+44.1%) from the reopening of border trade checkpoints.

For the first 8 months of 2023, exports contracted by -8.3% YoY in volume and +4.5% YoY in value (Figure 19). The export decline was due to the Myanmar market (-15.5% YoY). In the past, the average export price from Thailand has increased (+14.0% YoY), which is not attractive for imports. This is also because Thai operators have invested in and expanded their businesses in these markets. It is estimated that the volume of exports will decline by (-8.0)-(-10.0)% in 2023.

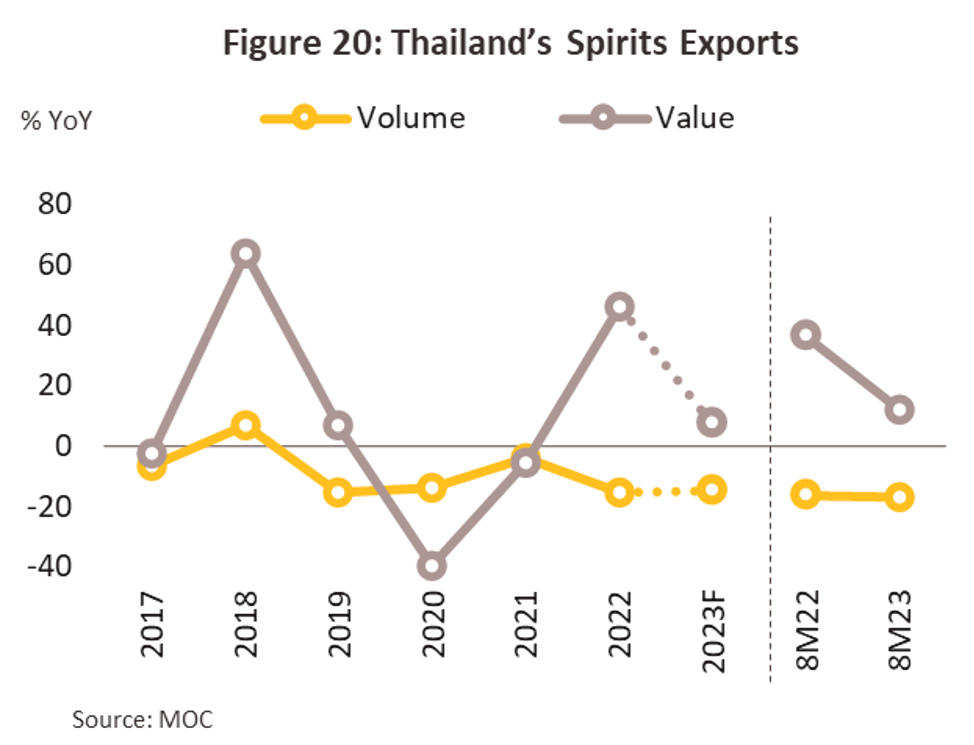

Liquor:

In 2022, exports of liquor contracted by -15.3% in terms of volume and +46.2% in terms of value. The decline in exports was due to the Taiwan market (-94.5%) and the Philippines market (-39.2%), which together account for 21.9% of the total volume of liquor exports from Thailand. This is because both countries reduced their imports of pure alcohol from Thailand. After the COVID-19 situation eased, this factor continued to cause exports to contract by -16.8% YoY in terms of volume and +11.9% YoY in terms of value in the first 8 months of 2023 (Figure 20). It is estimated that the volume of exports is expected to continue to decline in 2023 by (14.0)-(-16.0)%.

Key takeaways:

- The overall volume of exports of alcoholic beverages from Thailand is expected to contract by (-10.0)-(-11.0)% in 2023.

- The decline in beer exports is expected to continue due to the weakening of purchasing power in Myanmar and Cambodia.

- The decline in liquor exports is expected to continue due to the ongoing impact of the COVID-19 pandemic on the tourism industry in Taiwan and the Philippines.

Industry Outlook

The outlook for beverage production is expected to grow by an average of 1.5-2.5% per year. The growth drivers are:

- The El Niño phenomenon is causing temperatures in Thailand to rise, stimulating demand for beverages.

- Inventory levels are decreasing as businesses have been working to clear out excess inventory in recent months. Businesses are now building up inventory again to support the ongoing recovery of economic activity.

However, supply-side factors that could pressure production include rising raw material costs due to the more severe El Niño phenomenon. This is expected to lead to a decline in both the quantity and quality of water and agricultural products used as raw materials. Although packaging costs may decline somewhat due to the downward trend in energy prices.

By Product

- Non-alcoholic beverages: Domestic production is expected to grow by 2.0-3.0% annually. The main products are:

- Bottled and mineral water: Expected to expand by 2.0-3.0% per year.

- Soft drinks and soda: Expected to expand by 3.0-4.0% annually.

The expansion is mainly driven by a recovery in demand, particularly from the tourism industry. The number of foreign tourists is expected to return to pre-COVID-19 levels in 2028. This has led some manufacturers to increase capacity and develop new products, especially healthy beverages, to stimulate the market.

- Alcoholic beverages: Domestic production is expected to grow slightly at 1.0-2.0% per year. The main products are:

- Beer: Expected to grow slightly at 1.0-2.0% per year.

- Spirits: Expected to remain stable or grow slightly at 0.0-1.0% per year.

A recovery in demand from the tourism and entertainment industries drives the growth. However, there are still constraints on growth on the supply side, as the cost of raw materials used to produce alcohol, such as sugarcane and rice, is expected to rise due to the more severe El Niño phenomenon.

Key Takeaways

- The Thai beverage industry is expected to grow moderately in the coming years.

- Non-alcoholic beverages are expected to grow faster than alcoholic beverages, driven by the tourism industry’s recovery.

- Rising raw material costs are a potential headwind for the industry.

Outlook for Domestic Beverage Sales

Domestic beverage sales are expected to increase by 3.0-4.0% per year, driven by rising consumer demand from the following factors:

- Hot weather: The hot weather is expected to increase demand for beverages, especially water and soft drinks.

- Full recovery of the restaurant, hotel, pub, and bar industries: These industries are expected to drive demand for alcoholic beverages.

- Expansion of cities and modern retail stores: The expansion of cities and modern retail stores makes it easier for consumers to access beverages.

By Product

Non-alcoholic beverages: Non-alcoholic beverage sales are expected to increase by 3.5-4.5% per year, led by the following products:

- Bottled water and mineral water: Bottled water and mineral water sales are expected to increase by 3.0-4.0% per year, driven by the following factors:

- Consumers are increasingly concerned about product safety and cleanliness after the COVID-19 pandemic.

- Hot weather and drought are increasing demand for bottled water, especially in rural areas where consumers rely on bottled water due to the high salinity of seawater and the changing taste of tap water or groundwater in some areas.

- The expansion of cities and modern retail stores makes it easier for consumers to access bottled water.

- Soft drinks and soda: Soft drink and soda sales are expected to increase by 3.5-4.5% per year, driven by the following factors:

- The full recovery of the restaurant and hotel industries to support foreign tourists.

- Climate change, causing the world to become hotter, makes consumers want to consume beverages that refresh them and quench their thirst.

However, the latest strict measures to control the sweetness of beverage products, which took effect in April 2023, are still a constraint on the growth of this beverage group in the domestic market. However, some operators have developed soft drinks that meet the growing health consciousness of consumers, such as sugar-free or low-sugar soft drinks with low calories.

Alcoholic beverages: Alcoholic beverage sales are expected to remain stable or grow slightly at 0.0-2.0% per year, led by the following products:

- Beer: Beer sales are expected to grow by 1.0-2.0% annually.

- Spirits: Spirits sales are expected to grow slightly by 0.0-1.0% annually.

The growth of alcoholic beverages is driven by the clearer recovery of the tourism industry and the continued improvement of business activities, which support demand from the restaurant, pub, bar, and entertainment industries. However, factors that are holding back growth at a low rate include:

- The increasing trend of health consciousness is making some consumers reduce their consumption of alcoholic beverages.

- Distribution channels are still limited by regulations that allow the sale of alcoholic beverages only through offline retail stores, such as shops, department stores, and food and beverage businesses. Advertising is also prohibited, which prevents operators from presenting their products to consumers through media and online channels.

Despite these challenges, operators are still developing new products, especially beer with new flavors and improved ingredient quality to enhance satisfaction and the overall consumption experience.

Outlook for Beverage Exports

Beverage exports are expected to grow by 1.5-2.5% per year, driven by the following factors:

- The reopening of border checkpoints with neighbouring countries is an important export channel.

- The development of some beverage products that are becoming more popular overseas.

By Product

- Non-alcoholic beverages: Non-alcoholic beverage exports are expected to grow by 1.5-2.5% per year, led by the following products:

- Bottled water and mineral water: Bottled water and mineral water exports are expected to grow by 11.5-12.5% per year following the recovery of economic activities and the expansion of trade channels in the CLMV countries, such as Myanmar, Laos, and Cambodia, which are major trading partners and most of which still have areas lacking clean water that meets sanitary standards.

- Soft drinks and soda: Soft drink and soda exports are expected to contract by (-2.0)-(-3.0)% per year, as major trading partners, especially Cambodia and Myanmar, have seen increased investment from Thai companies, multinational companies, and local companies. Local beverage prices are also lower than imported goods.

- Energy drinks: Energy drink exports are expected to grow by 4.5-5.5% per year, driven mainly by Vietnam, where consumers are increasingly demanding fresh and quick sources of energy due to their increasingly busy and demanding lifestyles.

- Fruit juice: Fruit juice exports are expected to remain stable at 0.0-1.0% per year, with growth in China, where consumers are increasingly using fruit juice to mix with other beverages for health reasons. Demand from the United States, a major trading partner, may still recover slowly due to weak purchasing power and consumers being more cautious about spending.

- Alcoholic beverages: Alcoholic beverage exports are expected to contract by (-4.5)-(-5.5)% per year, led by the following products:

- Beer: Beer exports are expected to contract by (-4.0)-(-5.0)% per year.

- Spirits: Spirits exports are expected to contract by (-5.0)-(-6.0)% per year.

The contraction of alcoholic beverage exports is due to the following factors:

- The CLMV countries, which are major markets, are still cautious about spending on luxury goods due to the still fragile purchasing power.

- Domestic producers are facing high competition from the entry of both domestic and foreign investors.